If you’ve ever wanted to invest in property but never have the capital to buy a property, let alone multiple properties, then the London House Exchange, formerly known until 2022 as Property Partner, has you covered.

What is London House Exchange?

Up until the end of 2022, London House Exchange was trading as Property Partner.

Much like the what has happened to the stock and financial markets in recent years, London House has democratised investing in property in the same way.

You open an account and can invest in a selection of residential and commercial properties with as little as £10 or over £10,000. Whatever your budget or situation, this gives everyone a chance at investing in property.

One reason I now prefer putting away small amounts of capital, regularly, into property this way is the dividends seem to be high yield and more predictable than stocks. Each property on the London House Exchange has its dividend yield listed it.

The dividends are based on rent income and not just property share value, which gives a solid foundation for knowing what to expect coming in each month. Whether you take dividends for profit or reinvesting into your property portfolio, you can build a solid revenue stream from investing in property.

Founded in 2014, London House Exchange had, within its platform, traded £15 million between users by 2017 by buying and selling property shares. This went up to £15 million by 2022, with most of these funds returned to investors.

Important Note:

London House Exchange is authorised and regulated by the Financial Conduct Authority. This means it works within a legal framework and is recognised by an official body and as such your funds are protected. Find out more about the Financial Conduct Authority here.

The London House Exchange’s management is made of experts from the financial, property and tech sectors.

Their team are made up of:

CEO: Warren Bath

Having over 25 years of experience in financial services & investments, Warren Bath has been involved with mergers & acquisitions at Sky amongst other things and was Acting Director of Treasury, managing Sky’s liquidity, capital and bond financing. Before this he was Vice President of Morgan Stanley and has served similar roles as well as being a qualified Chartered Accountant.

CIO: Mark Weedon

With over 17 years of experience in property investments, Mark Weedon joined LHE in 2015, becoming Chief Investment Officer as of September 2022 after managing their mortgage portfolio from 2020.

Legal Director: Swetha Patel

With over 15 years of experience in law, over 10 of these years were in property law in private practice.

There, Swetha Patel specialised in acquisitions of multi million pound development sites, including mixed use buildings for housing providers and property companies.

This is How to Make Money From Rental Properties without the Headache and Cost

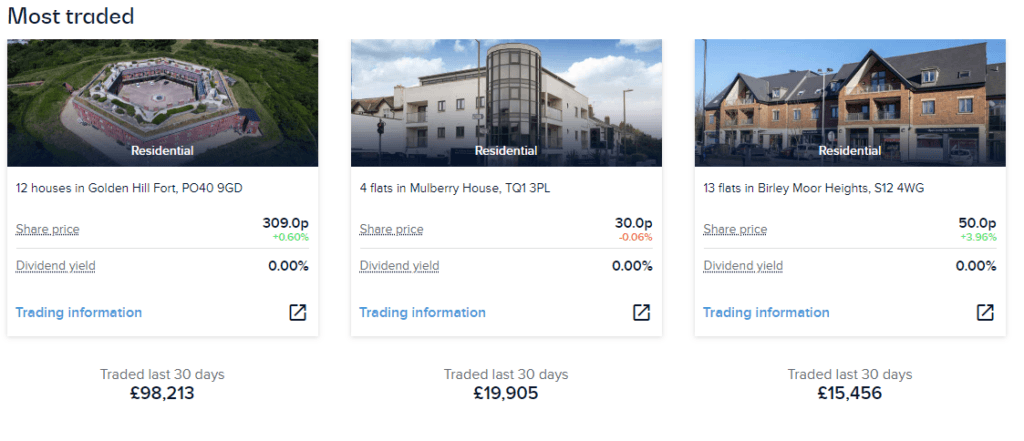

Within London House Exchange are a huge variety of properties you can buy shares in, from commercial units to residential and student housing. These types of properties means they will always be in demand.

The actual properties are sourced, mortgaged or paid for by London House Exchange and property traders can then buy and sell shares of them.

Within this framework, there is far more liquidity in the shares than would normally be available in the property sector. It really does make buying and selling shares in property more akin to the stock markets.

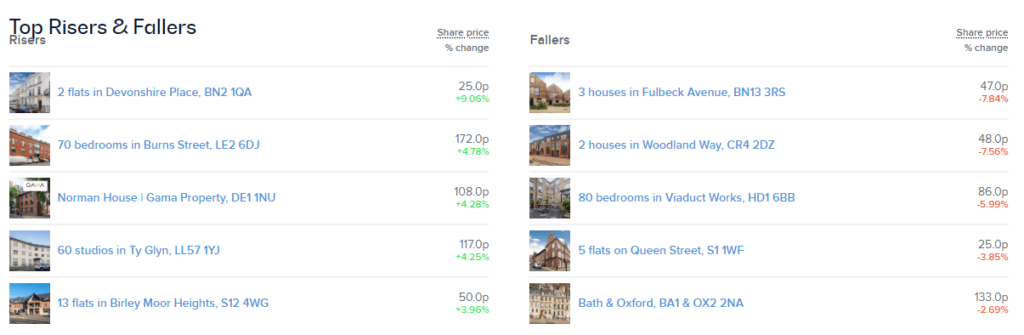

You can see from the current Top Risers and Fallers above the kinds of properties available all over the UK.

Share prices vary across all available properties, and just like the stock and financial markets, they can fall as well as climb.

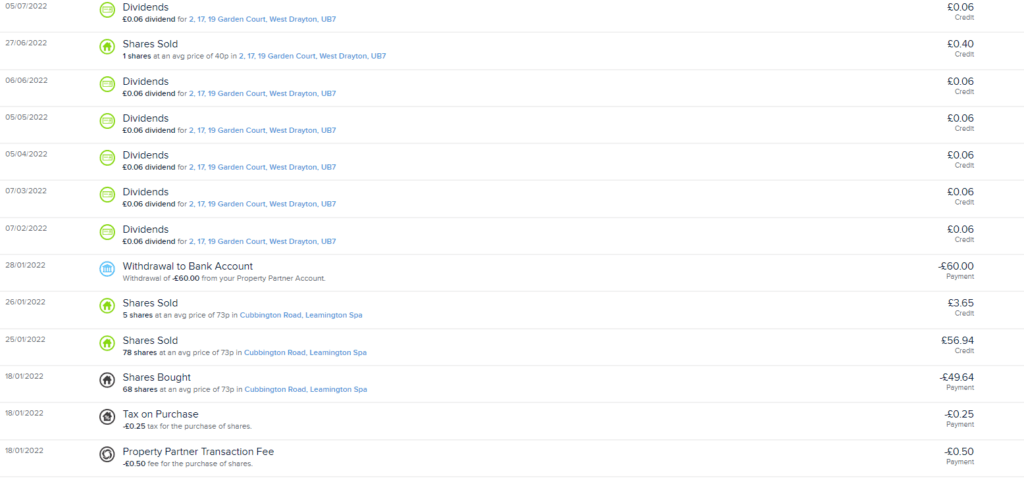

I brought shares for pennies in some properties whilst trying out London House Exchange (Property Partner at the time) as well as build up a selection of properties to form a relatively diverse portfolio.

You can see below how regular LHE pay out dividends…

You can also see how much it costs to purchase shares in property. Very little!

In much the same way as the likes of Trading 212 and eToro have made trading accessible to the masses, London House Exchange have done the same with property investing. You can now invest in property without a massive amount of money and earn profit from the rise of property value in the UK, rather than just suffer from it.

Using London House Exchange to invest in property is a great way to offset risk in the financial markets, assuming you have experience with trading.

How to Get Started Investing in Property in the UK

As with all things with investing, always bear in mind the following:

Investing in Property – Same as Stock and Currency

- Only use money you can afford to lose.

- Investing always carries a risk – shares & investments can drop in value as well as rise.

- If you are prone to gambling or have an addictive personality, property investing may not be suitable for you.

- Investing is best done over the long term. This is not a get rich quick scheme.

- No matter your portfolio size, you should create a diverse portfolio to spread the risk.

With that out of the way, you can create an account with London House Exchange by clicking below: